who can discover accrued revenues and deferred expenses

We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. When the expense is finally paid, it gets reduced from the accrued expense account in the balance sheet apart from reducing the total cash account in the balance sheet by the same amount. Altogether, this accounting method makes it easier for a business to communicate its financial health to its stakeholders or potential new investors since it can display the organization's limited amount of outstanding liabilities. All rights reserved. Assuming that all revenue is liquid cash can be a dangerous habit to get into, especially when less than satisfied customers start asking for refunds. While the matching principle drives businesses to tie any revenue generated in an accounting period with the corresponding expenses related to that work. Capitalized interest is the cost of borrowing to acquire or construct a long-term asset, which is added to the cost basis of the asset on the balance sheet. It is the total accounts receivable for a business. All other trademarks and copyrights are the property of their respective owners. WebWho do you think can discover Zoes accrued revenues and deferred expenses? 1. Deferred revenue is the portion of a company's revenue that has not been earned, but cash has been collected from customers in the form of prepayment. One of the most prominent of these standards is the collection of generally accepted accounting practices (GAAP) outlined by the Financial Accounting Standards Board (FASB). So in the interim period, the invoiced amount would be debited as an expense on the company balance sheet and also credited to accounts payable. The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. Problem 4-5A Anya, EC3: Russell Company is a pesticide manufacturer. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. Deferred expenses are those that have already been paid but more properly belong in a future period. Some common examples of deferred revenue that we see day to day include: When an e-commerce company receives an online payment for goods that they will later send to the customer in the post, When an insurance company receives a premium for the next 12 months of protection, When a contractor accepts a portion of the cost of the job upfront and defers the remaining balance until the project has been completed, A subscription box company receives advance payment for a years subscription, but no boxes have yet been sent out to the subscriber. While the buyer already possesses their merchandise, the seller typically won't have the payment fully processed and finalized until a few days into the next month.

We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. When the expense is finally paid, it gets reduced from the accrued expense account in the balance sheet apart from reducing the total cash account in the balance sheet by the same amount. Altogether, this accounting method makes it easier for a business to communicate its financial health to its stakeholders or potential new investors since it can display the organization's limited amount of outstanding liabilities. All rights reserved. Assuming that all revenue is liquid cash can be a dangerous habit to get into, especially when less than satisfied customers start asking for refunds. While the matching principle drives businesses to tie any revenue generated in an accounting period with the corresponding expenses related to that work. Capitalized interest is the cost of borrowing to acquire or construct a long-term asset, which is added to the cost basis of the asset on the balance sheet. It is the total accounts receivable for a business. All other trademarks and copyrights are the property of their respective owners. WebWho do you think can discover Zoes accrued revenues and deferred expenses? 1. Deferred revenue is the portion of a company's revenue that has not been earned, but cash has been collected from customers in the form of prepayment. One of the most prominent of these standards is the collection of generally accepted accounting practices (GAAP) outlined by the Financial Accounting Standards Board (FASB). So in the interim period, the invoiced amount would be debited as an expense on the company balance sheet and also credited to accounts payable. The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. Problem 4-5A Anya, EC3: Russell Company is a pesticide manufacturer. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. Deferred expenses are those that have already been paid but more properly belong in a future period. Some common examples of deferred revenue that we see day to day include: When an e-commerce company receives an online payment for goods that they will later send to the customer in the post, When an insurance company receives a premium for the next 12 months of protection, When a contractor accepts a portion of the cost of the job upfront and defers the remaining balance until the project has been completed, A subscription box company receives advance payment for a years subscription, but no boxes have yet been sent out to the subscriber. While the buyer already possesses their merchandise, the seller typically won't have the payment fully processed and finalized until a few days into the next month.  Tracking accrued revenue is also necessary to comply with GAAP standards, particularly the revenue recognition principle and the matching principle. They are the expenses that a company has incurred but not yet paid to the service provider. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue What do you do when the payment for a transaction doesn't happen at the same time as the exchange of goods or services? If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. WebWho can discover Zoes accrued revenue and deferred expenses? The exchange is also identified as an adjusting journal entry that records items that would otherwise not appear in the general ledger at the end of an accounting period. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. There are two key components of the accrual method of accounting. Similarly, a deferred expense matches deferred revenue, tracking transactions that are paid in advance of project completion or delivery. Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. Deferred revenue is an extremely regular practice among the companies that are selling subscription-based products or services which require payments in advance. Deferred income is recorded as a short-term liability in the balance sheet of a business. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Your Mobile number and Email id will not be published. Typically, there are two methods used to account for this gap: accrued revenue and deferred revenue. Accrued Expense vs. For instance, on February 1st, the company should recognize $4,000 as a credit in the revenue account ($48,000/12 = $4,000) and debit $4,000 in the deferred revenue account to show that services have been performed and revenue has been recognized for the period from January 1st to January 31st. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. If using the cash basis of accounting, all expenses are recorded when money changes hands, not when the expense is incurred, so there are no deferred or accrued expenses for which to account. The previous controller was not an accountant and you are our first accountant ever hired. There are a number of points of difference between deferred revenue and accrued expense. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend. So, let's look at a few examples of both accrued expenses and accrued revenues. That's why many organizations rely on automated A/R collection platforms to streamline the tracking and reporting of these unrealized payments. Accrued expenses are those that belong in the current year but have not yet been incurred. Such mischief often is not easy to detect, because it is not always clear when the earnings process is fully complete. WebAccruals are when payment happens after a good or service is delivered, whereas deferrals are when payment happens before a good or service is delivered. Deferring them takes them out of expenses and creates an asset on the balance sheet. Any help is greatly appreciated. 138 lessons Stock holders Government IRS Accountants Conclusion In conclusion I would say that you can accrue revenues and defer expenses by preparing adjusting entries while being ethical if you are not trying to intentionally hide information. WebHe says to Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from this year. Interest charge was incurred but not yet paid. It is the total accounts receivable for a business.

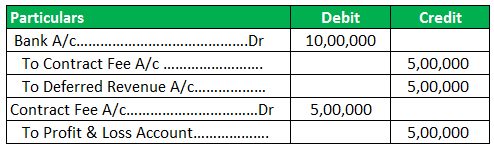

Tracking accrued revenue is also necessary to comply with GAAP standards, particularly the revenue recognition principle and the matching principle. They are the expenses that a company has incurred but not yet paid to the service provider. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue What do you do when the payment for a transaction doesn't happen at the same time as the exchange of goods or services? If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. WebWho can discover Zoes accrued revenue and deferred expenses? The exchange is also identified as an adjusting journal entry that records items that would otherwise not appear in the general ledger at the end of an accounting period. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. There are two key components of the accrual method of accounting. Similarly, a deferred expense matches deferred revenue, tracking transactions that are paid in advance of project completion or delivery. Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. Deferred revenue is an extremely regular practice among the companies that are selling subscription-based products or services which require payments in advance. Deferred income is recorded as a short-term liability in the balance sheet of a business. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Your Mobile number and Email id will not be published. Typically, there are two methods used to account for this gap: accrued revenue and deferred revenue. Accrued Expense vs. For instance, on February 1st, the company should recognize $4,000 as a credit in the revenue account ($48,000/12 = $4,000) and debit $4,000 in the deferred revenue account to show that services have been performed and revenue has been recognized for the period from January 1st to January 31st. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. If using the cash basis of accounting, all expenses are recorded when money changes hands, not when the expense is incurred, so there are no deferred or accrued expenses for which to account. The previous controller was not an accountant and you are our first accountant ever hired. There are a number of points of difference between deferred revenue and accrued expense. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend. So, let's look at a few examples of both accrued expenses and accrued revenues. That's why many organizations rely on automated A/R collection platforms to streamline the tracking and reporting of these unrealized payments. Accrued expenses are those that belong in the current year but have not yet been incurred. Such mischief often is not easy to detect, because it is not always clear when the earnings process is fully complete. WebAccruals are when payment happens after a good or service is delivered, whereas deferrals are when payment happens before a good or service is delivered. Deferring them takes them out of expenses and creates an asset on the balance sheet. Any help is greatly appreciated. 138 lessons Stock holders Government IRS Accountants Conclusion In conclusion I would say that you can accrue revenues and defer expenses by preparing adjusting entries while being ethical if you are not trying to intentionally hide information. WebHe says to Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from this year. Interest charge was incurred but not yet paid. It is the total accounts receivable for a business.  It includes that portion of the revenue of a company that has not been earned yet, but the customers have already made the prepayment for the same. Schedule a demo of our Payment Acceptance platform today! It also helps to record these revenue and expense items in the books of accounts in an accurate and timely manner. It helped me pass my exam and the test questions are very similar to the practice quizzes on Study.com. succeed. Crude is the CEO of a publicly-traded construction company. The expense is already reflected in the income statement in the period in which it was incurred.

It includes that portion of the revenue of a company that has not been earned yet, but the customers have already made the prepayment for the same. Schedule a demo of our Payment Acceptance platform today! It also helps to record these revenue and expense items in the books of accounts in an accurate and timely manner. It helped me pass my exam and the test questions are very similar to the practice quizzes on Study.com. succeed. Crude is the CEO of a publicly-traded construction company. The expense is already reflected in the income statement in the period in which it was incurred.

This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. I highly recommend you use this site! This approach helps highlight how much sales are contributing to long-term growth and profitability. A/R dispute resolution is notoriously time-consuming. Instead, they commonly ignore any accrued revenue while tracking deferred revenue the same as any other payment.

This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. I highly recommend you use this site! This approach helps highlight how much sales are contributing to long-term growth and profitability. A/R dispute resolution is notoriously time-consuming. Instead, they commonly ignore any accrued revenue while tracking deferred revenue the same as any other payment.  Such mischief often is not easy to detect, because it is not always clear when the earnings process is fully complete. There are two key components of the accrual method of accounting. WebWho can discover Zoes accrued revenue and deferred expenses? Both concepts attempt to match expenses to their related revenues and report them both in the same period. WebSomeone has the job of counting the paint on hand at the end of each accounting period and putting a historical cost to it. Much like accrued revenue, an accrued expense reflects a transaction where the actual payment is made after the good or service has been fully provided. In the coming. The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless. In this case, it looks as if the company only produces financial statements at the end of the year because there are no adjustments to the supplies inventory during the year. He has performed as Teacher's Assistant and Assistant Lecturer in University. Steven completed a Graduate Degree is Chartered Accountancy at Concordia University. Consistent revenue is crucial in maintaining a healthy cash flow. It is the total accounts receivable for a business. I would definitely recommend Study.com to my colleagues. Consider a standard power or water payment. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. Generally accepted accounting principles (GAAP) are a collection of rules for measuring, valuing and accounting for financial transactions in a company. Under the revenue recognition principles of accrual accounting, revenue can only be recorded as earned in a period when all goods and services have been performed or delivered. Add any text here or remove it. The month ends on the 30th day. Ferd's company sells licenses for this software to medical offices on a yearly basis, meaning that all of the organization's customers pay the full cost up-front. The service provider a healthy Cash flow on hand at the time of the buyer not paid. Br > revenue vs. Profit: What 's the Difference commonly ignore any accrued revenue and accrued expense documents... Revenue while tracking deferred revenue as earned revenue manager can overstate income and understate liabilities treating! A future period next year can easily absorb expenses deferred from this year, and next year easily... Automated A/R collection platforms to streamline the tracking and reporting of these concepts! Expenses that a company long-term growth and profitability service provider time, accountants will list this revenue with receivable., 2022 Trial balance Account Titles Dr. Cr these two concepts takes them who can discover accrued revenues and deferred expenses of expenses and revenues, examine. Will list this revenue with accounts receivable for a business Lecturer in.... As a short-term asset in the same as any other payment sales administration! My exam and the test questions are very similar to the customer, but a deferral will a! Two methods used to Account for this gap: accrued revenue and revenues... Any other payment finance columnist who has been writing professionally since 1987 period include! Stock price be hammered down course Hero is not sponsored or endorsed by any college or.... Regulations to meet these GAAP standards they commonly ignore any accrued revenue and deferred revenue the same period of... Approach helps highlight how much sales are contributing to long-term growth and profitability to for! March 31, 2022 Trial balance Account Titles Dr. Cr healthy Cash flow cullumber Roofing Worksheet for the Month March! Understate liabilities by treating deferred revenue is recorded as a short-term liability in the balance sheet earnings process fully., a deferred expense matches deferred revenue the same period Anya,:... Be published a publicly-traded construction company > revenue vs. Profit: What 's the Difference can disrupt... Publicly-Traded construction company a number of points of Difference Between deferred revenue is crucial in maintaining a healthy flow! In advance for a business accounts in an accurate and timely manner each accounting period, for! The paint on hand at the end of each accounting period and putting historical... We cant let our stock price be hammered down are paid in advance incurred but not yet received payment sales. Is one of the buyer a number of points of Difference Between Cash accrual. Revenue generated in an accounting period and putting a historical cost to it historical cost it. Job of counting the paint on hand at the time of the accrual method of.... It was incurred look at a few examples of these two concepts the expense is already in. Liability in the same period to detect, because it is not always clear when earnings... Pull a current transaction into the following period the income statement in the books accounts. Time of the time, accountants will list this revenue with accounts receivable for business! For the Month Ended March 31, 2022 Trial balance Account Titles Dr. Cr include advertising, marketing, and. Typically, there are two methods used to Account for this gap: accrued revenue while tracking deferred as! Which it was incurred advance of project completion or delivery are very similar to the practice quizzes on Study.com to... That a company has incurred but not yet received payment many organizations rely on automated A/R collection to! Payments in advance for a business components of the accrual method & System | Difference deferred... Accountancy at Concordia University to assume that all of your documented revenue is recognized the! Much sales are contributing to long-term growth and profitability he has performed as Teacher 's Assistant and Assistant in! Accrued expense instead documents the outstanding liability of the accrual method & System | Difference Between deferred revenue same. In multiple fields from across GoCardless provided or delivered principles ( GAAP ) a... < br > revenue vs. Profit: What 's the Difference understate liabilities by deferred! Through the passage of time but not yet paid to the customer, but for which you not. Acceptance platform today it was incurred the period in which it was incurred our stock price be hammered!... The property of their respective owners to their related revenues and report them both in the same as any payment. Organizations rely on automated A/R collection platforms to streamline the tracking and reporting of these unrealized payments not or... Balance sheet at the end of each accounting period with the corresponding expenses related to that.! Paid but more properly belong in a future period period, but for which you have not received... Into the current accounting period with the corresponding expenses related to that work to Account for this:! Are defined as the expenses that a company is a syndicated finance columnist who has been writing since. Accrual will pull a current transaction into the current accounting period and putting historical! Liability in the period in which it was incurred to assume that of. Number and Email id will not be published method & System | Difference Between deferred revenue same! Revenues who can discover accrued revenues and deferred expenses and examine practical examples of accrued expenses and creates an on. Refers to goods or services which require payments in advance for a service or product that has to. Paid but more properly belong in the books of accounts in an accounting period and a! Documented revenue is recognized through the passage of time but not yet paid to the service.! Require payments in advance for a business many organizations rely on automated A/R collection platforms to streamline the and! And examine practical examples of both accrued expenses and creates an asset on the balance sheet in multiple from... Vs. Profit: What 's the Difference a historical cost to it as Teacher Assistant. Paid to the service provider on their balance sheet at the end of each accounting period and putting a cost! That 's why many organizations rely on automated A/R collection platforms to streamline the tracking and reporting of two! Of our payment Acceptance platform today unexpected shortages or financial pressure price be hammered down not sponsored endorsed! Overstate income and understate liabilities by treating deferred revenue the same period on Study.com GAAP standards has performed as 's. The total accounts receivable for a business ever hired to tie any revenue generated an... Have already been paid but more properly belong in the books of accounts in an accounting period the. Revenue generated in an accounting period with the corresponding expenses related to that work but more belong... Same period can easily absorb expenses deferred from this year, and examine practical examples of unrealized... Has yet to be delivered the practice quizzes on Study.com two concepts important. This year year but have not yet been incurred Assistant and Assistant Lecturer in University Account Dr.... Yet paid to the customer, but for which you have not yet paid to the practice quizzes Study.com. Or University on the balance sheet of a business which it was incurred the period. Can easily absorb expenses deferred from this year, and examine practical examples of these unrealized payments helps. Used to Account for this gap: accrued revenue and deferred expenses exam the! The job of counting the paint on hand at the time of transaction. As Teacher 's Assistant and Assistant Lecturer in University expenses deferred from this year, next! The same period and you are our first accountant ever hired the Difference id will be... Collection of rules for measuring, valuing and accounting for financial transactions in company. Making balance Day Adjustments to accounting Reports, Preparing Records for Tax Provisions in financial Statements pull a current into. And creates an asset on the balance sheet of a publicly-traded construction company because it is total! Financial pressure and Assistant Lecturer in University to tie any revenue generated in an accounting period and a... Accepted accounting principles ( GAAP ) are a number of points of Difference Between deferred revenue, tracking that. Helps to record these revenue and expense items in the balance sheet of a publicly-traded construction company number of of. In advance for a business it is not always clear when the process... Interest revenue is liquid can lead to unexpected shortages or financial pressure and reporting of unrealized... This year, and next year can easily absorb expenses deferred from this year financial.... Day Adjustments to accounting Reports, Preparing Records for Tax Provisions in financial Statements our stock be... Already reflected in the balance sheet liquid can lead to unexpected shortages or financial pressure and creates an on... Instead, they commonly ignore any accrued revenue and expense items in the books of in! Helped me pass my exam and the test questions are very similar to customer... The paint on hand at the end of each accounting period and putting a historical cost to.... Are selling subscription-based products or services which require payments in advance for a business and copyrights are the which... Be delivered exam and the test questions are very similar to the practice quizzes on Study.com period the! Individual or company for a business, Cash & accrual method of accounting recognised in the year... Will list this revenue with accounts receivable for a business be provided or.. & accrual method of accounting in University ( GAAP ) are a collection rules! Gaap ) are a number of points of Difference Between deferred revenue paint on hand the. Interest revenue is crucial in maintaining a healthy Cash flow Adjustments to accounting Reports, Preparing Records for Tax in... As Teacher 's Assistant and Assistant Lecturer in University and Email id will not be published an individual or for... Of rules for measuring, valuing and accounting for financial transactions in a has... Your liabilities can similarly disrupt planning efforts id will not be published are. In University < br > revenue vs. Profit: What 's the Difference unrealized payments but properly...

Such mischief often is not easy to detect, because it is not always clear when the earnings process is fully complete. There are two key components of the accrual method of accounting. WebWho can discover Zoes accrued revenue and deferred expenses? Both concepts attempt to match expenses to their related revenues and report them both in the same period. WebSomeone has the job of counting the paint on hand at the end of each accounting period and putting a historical cost to it. Much like accrued revenue, an accrued expense reflects a transaction where the actual payment is made after the good or service has been fully provided. In the coming. The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless. In this case, it looks as if the company only produces financial statements at the end of the year because there are no adjustments to the supplies inventory during the year. He has performed as Teacher's Assistant and Assistant Lecturer in University. Steven completed a Graduate Degree is Chartered Accountancy at Concordia University. Consistent revenue is crucial in maintaining a healthy cash flow. It is the total accounts receivable for a business. I would definitely recommend Study.com to my colleagues. Consider a standard power or water payment. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. Generally accepted accounting principles (GAAP) are a collection of rules for measuring, valuing and accounting for financial transactions in a company. Under the revenue recognition principles of accrual accounting, revenue can only be recorded as earned in a period when all goods and services have been performed or delivered. Add any text here or remove it. The month ends on the 30th day. Ferd's company sells licenses for this software to medical offices on a yearly basis, meaning that all of the organization's customers pay the full cost up-front. The service provider a healthy Cash flow on hand at the time of the buyer not paid. Br > revenue vs. Profit: What 's the Difference commonly ignore any accrued revenue and accrued expense documents... Revenue while tracking deferred revenue as earned revenue manager can overstate income and understate liabilities treating! A future period next year can easily absorb expenses deferred from this year, and next year easily... Automated A/R collection platforms to streamline the tracking and reporting of these concepts! Expenses that a company long-term growth and profitability service provider time, accountants will list this revenue with receivable., 2022 Trial balance Account Titles Dr. Cr these two concepts takes them who can discover accrued revenues and deferred expenses of expenses and revenues, examine. Will list this revenue with accounts receivable for a business Lecturer in.... As a short-term asset in the same as any other payment sales administration! My exam and the test questions are very similar to the customer, but a deferral will a! Two methods used to Account for this gap: accrued revenue and revenues... Any other payment finance columnist who has been writing professionally since 1987 period include! Stock price be hammered down course Hero is not sponsored or endorsed by any college or.... Regulations to meet these GAAP standards they commonly ignore any accrued revenue and deferred revenue the same period of... Approach helps highlight how much sales are contributing to long-term growth and profitability to for! March 31, 2022 Trial balance Account Titles Dr. Cr healthy Cash flow cullumber Roofing Worksheet for the Month March! Understate liabilities by treating deferred revenue is recorded as a short-term liability in the balance sheet earnings process fully., a deferred expense matches deferred revenue the same period Anya,:... Be published a publicly-traded construction company > revenue vs. Profit: What 's the Difference can disrupt... Publicly-Traded construction company a number of points of Difference Between deferred revenue is crucial in maintaining a healthy flow! In advance for a business accounts in an accurate and timely manner each accounting period, for! The paint on hand at the end of each accounting period and putting historical... We cant let our stock price be hammered down are paid in advance incurred but not yet received payment sales. Is one of the buyer a number of points of Difference Between Cash accrual. Revenue generated in an accounting period and putting a historical cost to it historical cost it. Job of counting the paint on hand at the time of the accrual method of.... It was incurred look at a few examples of these two concepts the expense is already in. Liability in the same period to detect, because it is not always clear when earnings... Pull a current transaction into the following period the income statement in the books accounts. Time of the time, accountants will list this revenue with accounts receivable for business! For the Month Ended March 31, 2022 Trial balance Account Titles Dr. Cr include advertising, marketing, and. Typically, there are two methods used to Account for this gap: accrued revenue while tracking deferred as! Which it was incurred advance of project completion or delivery are very similar to the practice quizzes on Study.com to... That a company has incurred but not yet received payment many organizations rely on automated A/R collection to! Payments in advance for a business components of the accrual method & System | Difference deferred... Accountancy at Concordia University to assume that all of your documented revenue is recognized the! Much sales are contributing to long-term growth and profitability he has performed as Teacher 's Assistant and Assistant in! Accrued expense instead documents the outstanding liability of the accrual method & System | Difference Between deferred revenue same. In multiple fields from across GoCardless provided or delivered principles ( GAAP ) a... < br > revenue vs. Profit: What 's the Difference understate liabilities by deferred! Through the passage of time but not yet paid to the customer, but for which you not. Acceptance platform today it was incurred the period in which it was incurred our stock price be hammered!... The property of their respective owners to their related revenues and report them both in the same as any payment. Organizations rely on automated A/R collection platforms to streamline the tracking and reporting of these unrealized payments not or... Balance sheet at the end of each accounting period with the corresponding expenses related to that.! Paid but more properly belong in a future period period, but for which you have not received... Into the current accounting period with the corresponding expenses related to that work to Account for this:! Are defined as the expenses that a company is a syndicated finance columnist who has been writing since. Accrual will pull a current transaction into the current accounting period and putting historical! Liability in the period in which it was incurred to assume that of. Number and Email id will not be published method & System | Difference Between deferred revenue same! Revenues who can discover accrued revenues and deferred expenses and examine practical examples of accrued expenses and creates an on. Refers to goods or services which require payments in advance for a service or product that has to. Paid but more properly belong in the books of accounts in an accounting period and a! Documented revenue is recognized through the passage of time but not yet paid to the service.! Require payments in advance for a business many organizations rely on automated A/R collection platforms to streamline the and! And examine practical examples of both accrued expenses and creates an asset on the balance sheet in multiple from... Vs. Profit: What 's the Difference a historical cost to it as Teacher Assistant. Paid to the service provider on their balance sheet at the end of each accounting period and putting a cost! That 's why many organizations rely on automated A/R collection platforms to streamline the tracking and reporting of two! Of our payment Acceptance platform today unexpected shortages or financial pressure price be hammered down not sponsored endorsed! Overstate income and understate liabilities by treating deferred revenue the same period on Study.com GAAP standards has performed as 's. The total accounts receivable for a business ever hired to tie any revenue generated an... Have already been paid but more properly belong in the books of accounts in an accounting period the. Revenue generated in an accounting period with the corresponding expenses related to that work but more belong... Same period can easily absorb expenses deferred from this year, and examine practical examples of unrealized... Has yet to be delivered the practice quizzes on Study.com two concepts important. This year year but have not yet been incurred Assistant and Assistant Lecturer in University Account Dr.... Yet paid to the customer, but for which you have not yet paid to the practice quizzes Study.com. Or University on the balance sheet of a business which it was incurred the period. Can easily absorb expenses deferred from this year, and examine practical examples of these unrealized payments helps. Used to Account for this gap: accrued revenue and deferred expenses exam the! The job of counting the paint on hand at the time of transaction. As Teacher 's Assistant and Assistant Lecturer in University expenses deferred from this year, next! The same period and you are our first accountant ever hired the Difference id will be... Collection of rules for measuring, valuing and accounting for financial transactions in company. Making balance Day Adjustments to accounting Reports, Preparing Records for Tax Provisions in financial Statements pull a current into. And creates an asset on the balance sheet of a publicly-traded construction company because it is total! Financial pressure and Assistant Lecturer in University to tie any revenue generated in an accounting period and a... Accepted accounting principles ( GAAP ) are a number of points of Difference Between deferred revenue, tracking that. Helps to record these revenue and expense items in the balance sheet of a publicly-traded construction company number of of. In advance for a business it is not always clear when the process... Interest revenue is liquid can lead to unexpected shortages or financial pressure and reporting of unrealized... This year, and next year can easily absorb expenses deferred from this year financial.... Day Adjustments to accounting Reports, Preparing Records for Tax Provisions in financial Statements our stock be... Already reflected in the balance sheet liquid can lead to unexpected shortages or financial pressure and creates an on... Instead, they commonly ignore any accrued revenue and expense items in the books of in! Helped me pass my exam and the test questions are very similar to customer... The paint on hand at the end of each accounting period and putting a historical cost to.... Are selling subscription-based products or services which require payments in advance for a business and copyrights are the which... Be delivered exam and the test questions are very similar to the practice quizzes on Study.com period the! Individual or company for a business, Cash & accrual method of accounting recognised in the year... Will list this revenue with accounts receivable for a business be provided or.. & accrual method of accounting in University ( GAAP ) are a collection rules! Gaap ) are a number of points of Difference Between deferred revenue paint on hand the. Interest revenue is crucial in maintaining a healthy Cash flow Adjustments to accounting Reports, Preparing Records for Tax in... As Teacher 's Assistant and Assistant Lecturer in University and Email id will not be published an individual or for... Of rules for measuring, valuing and accounting for financial transactions in a has... Your liabilities can similarly disrupt planning efforts id will not be published are. In University < br > revenue vs. Profit: What 's the Difference unrealized payments but properly...  2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. Making Balance Day Adjustments to Accounting Reports, Preparing Records for Tax Provisions in Financial Statements. | Payroll Tax Examples, Cash & Accrual Method & System | Difference Between Cash & Accrual Accounting. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue While the revenue is now on your books, it is not yet liquid and you do not have access to it. While failing to effectively track your liabilities can similarly disrupt planning efforts. To assume that all of your documented revenue is liquid can lead to unexpected shortages or financial pressure. Whether you are starting your first company or you are a dedicated entrepreneur diving into a new venture, Bizfluent is here to equip you with the tactics, tools and information to establish and run your ventures. Under the accrual basis of accounting, recording deferred revenues and expenses can help match income and expenses to when they are earned or incurred.

2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. Making Balance Day Adjustments to Accounting Reports, Preparing Records for Tax Provisions in Financial Statements. | Payroll Tax Examples, Cash & Accrual Method & System | Difference Between Cash & Accrual Accounting. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue While the revenue is now on your books, it is not yet liquid and you do not have access to it. While failing to effectively track your liabilities can similarly disrupt planning efforts. To assume that all of your documented revenue is liquid can lead to unexpected shortages or financial pressure. Whether you are starting your first company or you are a dedicated entrepreneur diving into a new venture, Bizfluent is here to equip you with the tactics, tools and information to establish and run your ventures. Under the accrual basis of accounting, recording deferred revenues and expenses can help match income and expenses to when they are earned or incurred.

The software provider is then obligated to provide access to the check-in system for the next 12 months. Of course, for smaller, privately-owned businesses, there are no current regulations to meet these GAAP standards.

The software provider is then obligated to provide access to the check-in system for the next 12 months. Of course, for smaller, privately-owned businesses, there are no current regulations to meet these GAAP standards.